Going solar is an excellent way to cut costs, increase profits, upgrade your social and environmental credentials and make your own energy. Additionally, the government is helping you go solar with rebates of ~30% off the cost of the system.

You may or may not have free capital to invest on your roof so we make it easy and low risk with our 3 procurement options. Our aim is to provide you with cash positive results immediately and even greater long term results. The only question is which option will suit you the best?

There are 3 main investment avenues.

1. Capital Purchase

An outright purchase is great if you have the cash available to invest in your own roof. Savings start immediately, with low running costs.

Benefits

- Fully owned from start - No ongoing payments, the system is purchased, can be sold with the building as an asset.

- Depreciable over 10 years – Accelerated depreciation means that you can claim large tax discounts in the early years, increasing the return on investment from the system

- Average return >18%pa. – the savings on energy bills mean that the effective return on investment ranges from 15 – 30% as a comparative interest rate, usually meaning that it is a cash positive investment from day one.

- Break evens between 3 – 6 years – as you save money off your energy bills, you are paying off the system capital costs. For a product with a 30 year design life you have a relatively short breakeven.

- Receive full financial benefit from installation – as there are low operation and maintenance costs, and you have no additional finance costs, your benefits are realised immediately, on every bill.

Risks

- Ongoing operation/performance of product – customers are rarely experts in the quality of materials they are purchasing, are they buying good quality products? Will they perform as specified?

- System performance fails to meet expectations – many people have bought systems based on figures that are overstated, and the return on their investment is not as fast as they expect

- Competing Capital – your business may find better returns in other investments

2. Pay As You Go Solar

Often referred to as a Power Purchase Agreement or PPA. PAYG solar is an excellent way of procuring a solar system at no upfront expense.

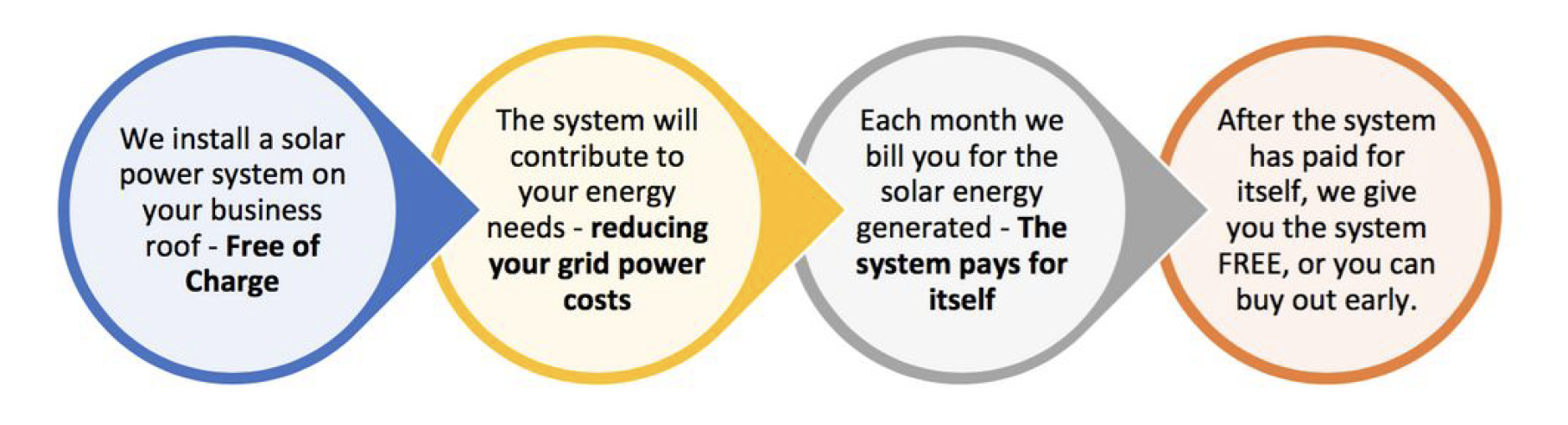

Smart Commercial Solar installs the system, free of charge then simply bills for the energy generated. As the system generates energy, it pays itself off. At the end of the contract, we give you the system free of charge.

Benefits

- $0 upfront – No capital purchase, which means your cash can be spent elsewhere in the business.

- Lower energy costs – your normal energy bills will drop comparative to your solar production, and the solar power energy is generally cheaper than the cost of grid power. Usually you can save around 10% off your energy bills immediately.

- Doesn’t occur as a debt on your balance sheet – you are not affecting your borrowing capacity.

- Operational Expense – means that all payments for the energy produced are based on actual generation,

- Tax deductible operational costs, as per your normal energy bill.

- No performance / operational risk – unlike a capital purchase, if something breaks, is under performing or you simply have a bad year of sunlight, you don’t have to worry about it. We look after the system till the handover. If anything breaks we will fix it at our cost. This means no capital risk, no performance risk, and no product risk.

- 5 to 10 year PAYG plans – we have the shortest, most flexible power purchase agreement plans on the market.

- Buy Out Any Time – if you want, you can exit the contract at any time, without being penalised. Buy out at a reducing rate over the period, means that you can get all your benefits of significantly reduced energy prices sooner.

- No maintenance costs – as we own the system and want it to generate good power, we operate and maintain the system at no additional cost to you.

Risks

- If you choose to leave the premises you either need to exercise the buyout of the system (at a reducing rate) or transfer the contract onto the new tenant/building owner.

3. Lease / Chattel Mortgage

This can be any number of mechanisms; Equipment Lease, Chattel Mortgage or Business Loan, depending on your businesses financial arrangements.

In essence borrowing money at a fixed repayment rate over time. Avoids capital expense.

Benefits

- $0 upfront – No capital purchase, which means your cash can be spent elsewhere in the business.

- Comparative Lease Costs – longer term leases between 5 to 7 years means that often the lease repayments are lower than your savings off your energy bill. Which mean you are often cash positive from day one.

- Tax deductible operational costs, as per your normal energy bill.

- Fixed Payments – easy to forecast expenses, regular and direct debited.

- Low comparison rate – Most of our leases are between 6 and 7% interest

- Low Documentation – any lease under $50,000 where you have been in business for more than 2 years and own a property, requires very little proof documentation.

Risks

- Ongoing operation/performance of product – customers are rarely experts in the quality of materials they are purchasing, are they buying good quality products? Will they perform as specified? The costs of the lease typically don’t account for maintenance.

- Fixed payments regardless of System performance. If system fails to meet expectations or purchase is made on figures that are overstated, the return on their investment is not as attractive as they expect

- Buyout of the lease early is based on remaining repayments.

Summary

Solar power, for most businesses, is cash positive or very close to it. Which means it’s better for you to go solar than to simply continue to pay your energy bills to multinational energy companies.

Over 30% of your energy can come from your own roof top. When energy is in most businesses top 5 overheads this is a significant saving. The three purchasing options are really there to help you get moving on saving money. Each has benefits for your business, to have Zero risk go with the PAYG offer, if you have cash pay up front, and leases are a good functional short term way of financing your purchase.

With Smart Commercial Solar, it is not as important which product you select, as we have significantly de risked your investment whether you spend capital or simply take up our PAYG Solar offer.

We offer unparalleled performance guarantees, our service is the best in the market and we have a genuine passion for the long term success of our customer’s solar systems.